Luxury sales have turned the real estate economy on its head. Just a few months ago, sales were shaped like a pyramid, with demand greatest for lower priced properties. Now sales of high priced homes are leading the recovery.

A new analysis of existing sales by an economist at the National Association of Realtors found that sales growth is highest in the $750,000 to $1 million price tier, and homes priced at $500,000 or more were 11.6 percent of sales in May.

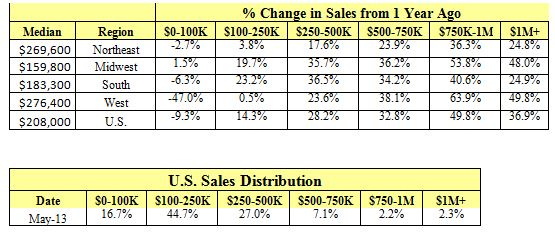

“By price tier, sales were up from a year ago in all price categories in all regions except in the lowest price tier, although the Midwest was an exception to this categorization; sales were up slightly in the under $100,000 category in that region. Inventory is more plentiful in these price tiers, construction seems limited, and distressed sales are anticipated to continue to drop. Expect the share of higher priced homes among those sold to remain above the 10 percent level for the duration of the summer selling season, and possibly into the off-season,” wrote Research Economist Danielle Hale.

Just two weeks ago, the Institute for Luxury Home Marketing’s index for luxury sales moved from seller’s to buyer’s market on a national level for the first time in memory (see Luxury Homes Officially Enter Seller’s Market).

In April, sales growth was highest in the higher price tiers but the highest growth tier varied by region. In May, the highest-growth price tier for all regions was the $750,000 to under $1 million category. In fact, in the Midwest and West, sales in that price tier were up more than 50 percent from a year ago.

Median prices in May were in the $100,000 to $250,000 price category in the Midwest and South but fell into the higher $250,000 to $500,000 category in the Northeast and West. Looking at all homes in the country, the median falls into the $100,000 to $250,000 price range.

Sales in the lowest price tier began to show less growth and even decline in some areas in 2012. Unsurprisingly, this was the same period when we saw the biggest tapering off in reports of distressed sales in our survey of practitioners. Still, even after the decline in sales in this category and growth in higher price tiers, one out of every six homes sold nationally is priced less than $100,000, she said.

Luxury Sales are Growing Faster than any other Segment

Print

Print

0 Comments For This Post

1 Trackbacks For This Post

July 5th, 2013 at 8:05 pm

[…] Author Steve Cook: https://www.realestateeconomywatch.com/2013/07/luxury-sales-grow-faster-than-other-price-tiers/ About Steve CookSteve Cook is Executive Vice President of Reecon Advisors and covers government […]

Leave a Reply