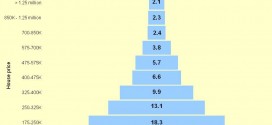

This month’s median asking price of properties listed for sale in 54 markets hit the highest level since July 2010, the final month of the homebuyer tax credits. This month’s national median asking price, $238,118, is 2.8 percent over a year ago and 0.4 percent higher than last week.

Asking prices have been rising steadily since the first of the year, an indication of seller confidence. At the same time, inventories are down 22 percent from a year ago, suggesting sellers are still waiting until markets improve, according to data from HousingTracker.net.

Markets with the greatest weekly price increases in the first week of June are: Raleigh (12.7%), Reno (2.8%), Sacramento (2.5%), Jacksonville (2.4%) and Honolulu (2.2%). Greatest weekly losers were Chicago (1.1%), New York (1.1%) and Tampa (0.6%).

The asking price data reflects greater price optimism in the market place among sellers today than the American public has for all of next year.

The latest monthly Fannie Mae Homeownership survey, released yesterday, found that Americans expect home prices to increase by only 1.4 percent over the next 12 months, up 0.5 percentage points since March 2012 and the highest value yet recorded. Thirty-four percent of respondents said that home prices will go up in the next 12 months, the highest level recorded since March 2011.

Yet the increase expected among the general population is only half as great as the year-over-year increase already recorded in list prices. List prices generally are higher than actual sales prices, but they are a good leading indicator of price trends.

RealEstateEconomyWatch.com Insight and Intelligence on Residential Real Estate

RealEstateEconomyWatch.com Insight and Intelligence on Residential Real Estate