An analysis by Chris Porter, a senior manager at the John Burns Real Estate Consulting practice, has some frightening findings for the housing industry. Americans aged 30 to 34 years old in 2012 had the lowest homeownership rate of any similarly aged group before them… yet just five years earlier, in 2007, the same people had the highest homeownership rate at 25-29 years old than any group before them.

Porter calls it an amazing reversal of fortune and possibly the most amazing, underreported demographic fact today.

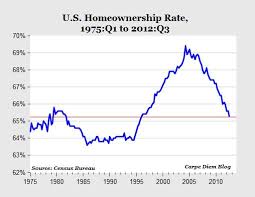

Using homeownership-by-age data from the Census Bureau, Porter compared households by years of birth to examine how homeownership changes over consumers’ lifetimes.

• Lowest ever in 2012: 30-34 year-olds in 2012 (born between 1978 and 1982) had a 47.9% homeownership rate. This is a full 6.5 percentage points lower than those five years older had achieved at the same age and lower than any group before them! (This is based on data available beginning with those born in 1948.) Porter calls them the “Subprime Generation.”

• Highest ever 5 years prior: Those same 30-34 year-olds had a 40.5% homeownership rate 5 years prior when they were 25-29 years old in 2007. This is 6.2 percentage points higher than 25-29 year-olds in 2012 and higher than any 5-year cohort before them.

‘Our consulting team has been pointing out a real dearth of entry-level buyers over the last several years, which is counterintuitive when you consider that this has been the most affordable time in generations to buy a home. What we learned is that a huge percentage of households bought a home earlier than usual, and that same group has gone through more foreclosures than any generation before them,” Porter wrote in his blog.

What does this mean? It is more difficult than usual to sell entry-level homes today, but the pent-up demand for entry-level housing is huge, he said.

RealEstateEconomyWatch.com Insight and Intelligence on Residential Real Estate

RealEstateEconomyWatch.com Insight and Intelligence on Residential Real Estate

One comment

Pingback: Thirty Somethings Flip-Flopped on Homeownership | Belair Realty