Price growth will plummet to an annual rate of only 0.9 percent for the balance of the year after the tumble began with a stumble when price increases fell to just a 0.9 percent quarter over quarter growth rate at the end of second quarter in June.

That’s the latest prognosis from Dr. Alex Villacorta, Clear Capital’s vice president of research and analytics.

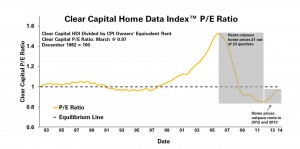

“When all is said and done, we expect to see 2014 year-end housing gains fall in line with historical rates of 3percent-5percent, with growth of just 3.9percent. Between 1984 and 2013, national home prices grew on average 3.2percent per year. We have seen this coming since December 2013. Clear Capital’s update to our 2014 forecast confirms national home prices moderating over the next six months.

“The low price tier, one of the key drivers of the recovery, has put on the breaks. Through the end of 2014, national annual rates of growth will be more than cut in half from the current 12.4 percent to just 5.6percent. By Q4, quarterly growth across all three price tiers is set to fall below 1 percent, with the low tier forecast showing the weakest quarterly growth of all,” Villacorta said.

National levels of distressed saturation fell below 20 percent for the first time since February 2008. This is certainly a good move for the long-term health and stability of the market, though discounted distressed opportunities particularly among investors helped to jump start the recovery. Improvements in distressed market measures mean other economic measures, like consumer confidence and the job market, must continue to improve to support the recovery.

Atlanta and San Jose should each continue a relatively strong recovery, leading the top 50 MSAs with 2.9percent growth through the end of 2014. The markets’ drastically different distressed saturation rates, however, signal they have very different demand drivers.

Detroit, on the other hand, is slated to see declines of 4.6percent over the next six months, to end the year with total growth just under 2percent. Detroit continues to see large variability in price trends in part influenced by low price points, with a median price of $115,000.

“Our mid-year forecast continues to support the initial 2014 projection for national price growth we made back in December 2013, with overall home prices expected to end the year up 3.9 percent,” said Dr. Villacorta, “While it might feel like a shock to market participants and observers who have grown used to double digit price growth, the market’s continued move back toward long-run historical levels and growth rates is something we have expected. What we will be watching for, however, is whether the market settles into this historical sweet spot or whether prices continue to underperform historical norms.

“Declining distressed saturation levels are an undeniable sign that we’re transitioning back to pre-bubble norms. As markets fall back toward 3percent-5percent historical rates of growth, we hope stability will restore consumer confidence and help support this healthy rate of growth in the long-term.

“Yet, any hint of declines in prices over the winter could have a negative effect on the spring buying season in 2015. There is real concern that the markets are not quite strong enough to withstand any further shocks. Uncertainty surrounding drivers like household formations, move up buyers on lock down with underwater mortgages, and constraints in the job market could limit the market’s ability to sustain any type of growth moving forward.”

RealEstateEconomyWatch.com Insight and Intelligence on Residential Real Estate

RealEstateEconomyWatch.com Insight and Intelligence on Residential Real Estate

One comment

Pingback: Clear Capital: Prices Start to Stumble in June | Belair Realty