“It is important to recognize that 2016 is shaping up to be the best year in recent memory to sell. Supply remains very tight, so inventory is moving faster. Given the forecast that price appreciation will slow in 2016 to a more normal rate of growth, delaying will not produce substantially higher values, and will also see higher mortgage rates on any new purchase,” wrote Realtor.com Chief Economist Jonathan Smoke recently.

Should his sage advice to sellers fall on deaf ears, 2016 could produce one of the most miserable housing market in years. After seven years of struggle, the issue no longer is demand, it’s supply. Anemic inventories are artificially driving up prices that keep first-time buyer trapped in rentals, which as expect to soar again this year.

Home sales prices have risen between 15 and 20 percent over the past three seasons, depending on which series you believe. We’re less than 18 months away from reaching a national median sales price that’s higher than the very highest peak at the very top of the housing bubble in 2006.

Frozen stiff without enough equity to sell for nearly decade, owners at last have made it to the light at the end of the tunnel. They can sell and cash out. They can refi or take out a HELOC and stay put. Moreover, with experts predicting that sale prices will moderate in 2016 to 4-5 percent appreciation from 6 percent as the market slow down to catch, this could be the perfect year to sell.

With the clock ticking on the opening of the 2016 season, now is the time potential sellers are making up their minds to sell or not.

Fannie Mae

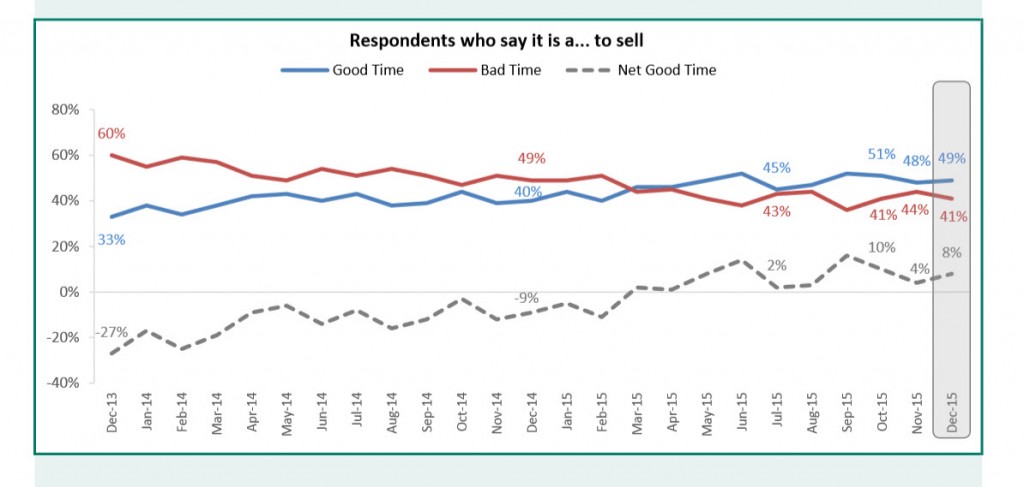

In Fannie Mae’s December Home Purchase Sentiment Index, fewer than half of respondents said it’s a good time to sell (49 percent) and 41 percent said it’s a bad time to sell. Not exactly a strong endorsement but at least movement in the right direction. The best thing about the findings was that in November the sentiment to sell was even lower—48 percent said it was a good time and percent and 44 percent said it was a bad time.

In December less than half of Fannie Mae’s survey sample said it’s a good time to sell.

In December less than half of Fannie Mae’s survey sample said it’s a good time to sell.

The net percentage of respondents who say it is a good time to sell a house rose after falling for two months in a row – rising 4 percentage points to a net 8 percent positive at the end of the year. Not much of an improvement over last year.

“Brightening economic prospects, if sustained, should stimulate demand for homeownership. However, continuing upward pressure on rental prices and constrained housing supply, particularly for starter homes, may mean prospective first-time home buyers could face affordability constraints,” said Fannie Mae’s Doug Duncan.

Twenty percent 0f Trulia’s sample of consumers said 2016 will he a better year to sell than 2015, and 36 percent more than in 2014.

Trulia

Trulia’s housing predictions survey showed real positive change as consumers recognized 2016 is a significantly better climate to sell than 2015 was. Some 20 percent said it will be better than 2015 to sell and 14 percent said it 2015 would he better than 2014, for a net gain of 36 percent in two years, more than a third of consumers.

What’s causing the uptick in 2016? Trulia’s Ralph McLaughlin wrote: “The Federal Reserve has expressed commitment to raising rates at the end of 2015 or early 2016, and consumers may be getting anxious about the prospect of increased mortgage rates. A higher percentage of Americans think getting a mortgage to buy (25%) or refinance (22%) a home will become harder in 2016 than those who think it will be easier (20% for both), even though increased mortgage rates won’t affect the financial advantages of buying in most housing markets.”

NAR’s Traffic Survey may provide the first real indication of whether sellers will step up to the plate in 2016.

NAR’s Traffic Reports

It’s one thing to ask a sample of consumers if it’s a good time to sell. Since most of them aren’t homeowners or homeowners with ant plans to sell their opinions are just that—opinions. NAR, in one of the most low-tech but highly interesting ways to measure trends, counts buyer and seller traffic to its broker-me

Heres what the latest traffic report says about sellers (red line above). Its to be expected that all all activity will slow with the holidays and November is a little soon to expect sellers to line up for the spring season. However, it’s worth watching this report (published in NAR’s monthly Realtor Confidence Index) in the coming winter months to see whether sellers are going to step up to the plate.

RealEstateEconomyWatch.com Insight and Intelligence on Residential Real Estate

RealEstateEconomyWatch.com Insight and Intelligence on Residential Real Estate

One comment

Pingback: Inventory Update: Get the Cavalry Ready | RealEstateEconomyWatch.com