Transaction prices reported by multiple listing services may differ by an average of 8.75 percent from sold prices reported on HUD-1 settlement statements, possibly because brokers are under pressure to inflate prices in a declining market, according to a new study by three real estate economists at Florida Gulf Coast University published last month by the Appraisal Journal.

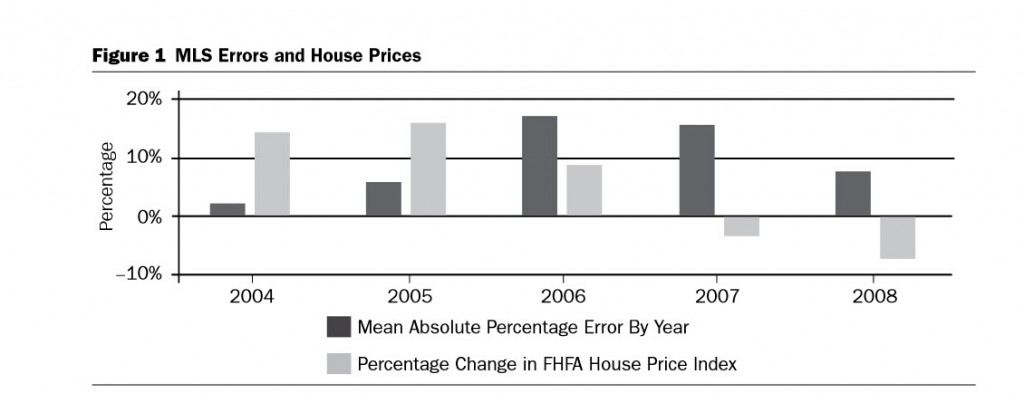

The study found MLS errors are related to market conditions, not property price levels, and are likely to be smaller during a market boom and larger during a market bust. The study found that MLS-reported prices supplied by brokers on or after the settlement date overstated HUD-reported prices in 6.25% of the sample and understated HUD-reported prices in 2.50%. The data used in the analysis were drawn from the two years before, the year of, and the two years after the market peak between 2004 and 2008. The study compared HUD-1 and MLS prices from a sample of 670 HUD-1 Settlement Statements obtained from two banks operating in a Southern state.

Source: “Reported Price Errors:A Caveat for Appraisers” in The Appraisal Journal

Source: “Reported Price Errors:A Caveat for Appraisers” in The Appraisal Journal

“This finding is consistent with, but certainly does not prove, the notion that if brokers are motivated to inflate MLS prices, pressure to do so is likely to be greater in declining markets. However, there may be other explanations for the price discrepancies. One such explanation is the possibility that during declining markets, brokers may report initial contract prices that may be subject to downward adjustment between contract and settlement dates. A related possibility is that some prices are renegotiated at the time of closing to accommodate buyers’ cash needs. Regardless of explanation, however, the result is a misstating of price,” the authors concluded.

The study urged appraisers to use other sources in addition to MLS transaction prices to verify reported sale prices, especially when a sale price contradicts sale prices of comparable properties.

“Reported Price Errors: A Caveat for Appraisers,” by Marcus T. Allen, Ph.D., Kenneth M. Lusht, Ph.D., MAI, SRA, and H. Shelton Weeks, Ph.D., all from Florida Gulf Coast University, was published the week of December 15 by the Appraisal Journal, the quarterly technical and academic publication of the Appraisal Institute, the nation’s largest professional association of real estate appraisers.

RealEstateEconomyWatch.com Insight and Intelligence on Residential Real Estate

RealEstateEconomyWatch.com Insight and Intelligence on Residential Real Estate

One comment

Pingback: New Study Suggests MLS Sold Prices are Inflated in Down Markets | Belair Realty