Buying a home remains a real bargain compared to renting in most areas nationwide, as the share of income typically needed to afford the average home is much lower today than it was in the past. But while buying a home is a great deal, for those current renters looking to buy — particularly millennials — saving up the necessary down payment can be a real challenge as rents keep rising.

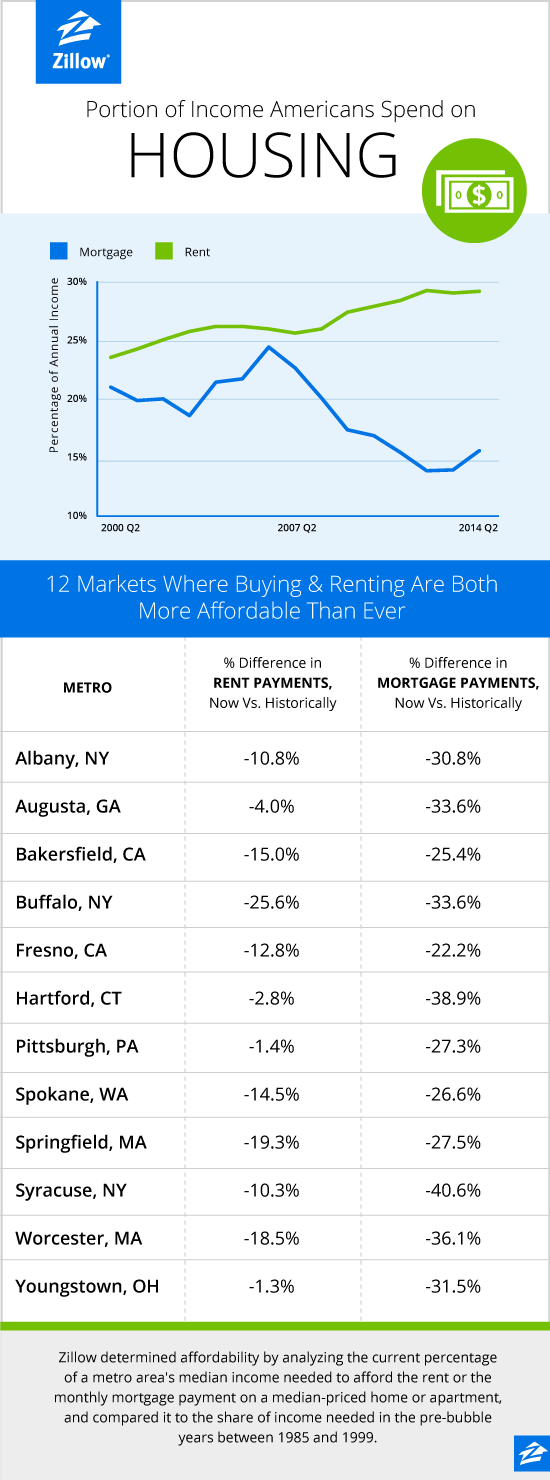

Zillow’s July Real Estate Market Reports examined both mortgage affordability and rental affordability nationwide and in dozens of large markets. U.S. home buyers should currently expect to pay 15.3 percent of their incomes to a mortgage on the typical home, far less than the 22.1 percent share homeowners devoted to mortgages in the pre-bubble years between 1985 and 1999.

As of June, home buyers in just six of the country’s 100 largest metro markets analyzed by Zillow were paying a larger portion of their incomes today than historically in order to buy their area’s median-priced home. This widespread affordability is driven largely by very low mortgage rates, which help keep overall monthly costs down for home buyers.

But mortgage rates are expected to rise in the coming year. When mortgage rates hit 5 percent, still very low by historical standards, the number of unaffordable metros for homeowners among the top 100 will more than double, to 13. At 6 percent mortgage interest rates, the number of unaffordable metros will almost double again, to 24.

Renters, meanwhile, are facing a much different environment. Rents didn’t experience the huge drop seen in home values during the recession, and instead have just kept chugging upward for much of the past decade. Plus, renters can’t take advantage of very low mortgage rates, like home buyers can. As a result, renters signing a lease today should expect to pay about 29.5 percent of their income to rent, compared to 24.9 percent in the pre-bubble period. In 88 of the nation’s 100 largest metro areas, renters should currently expect to pay a larger share of their income toward rent than they would have historically.

The disparities between homeowners and renters are magnified among the millennial generation. Because a much larger proportion of millennials rent compared to other generations such as Generation X and baby boomers, the problem of saving up for a down payment and other costs associated with homeownership is much greater among younger potential home buyers.

“The affordability of for-sale homes remains strong, which is encouraging for those buyers that can save for a down payment and capitalize on low mortgage interest rates. But the health of the for-sale market is directly tied to the rental market, where affordability is really suffering,” said Zillow Chief Economist Dr. Stan Humphries. “As rents keep rising, along with interest rates and home values, saving for a down payment and attaining homeownership becomes that much more difficult for millions of current renters, particularly millennial renters already saddled with uncertain job prospects and enormous student debt. In order to combat this phenomenon, wages need to grow more quickly than they are, particularly for renters, and growth in home values will need to slow.”

The median annual income nationwide was $53,216 as of the end of the second quarter. But according to the Census Bureau, homeowners and renters make drastically different salaries — homeowners make $65,514 per year, while the typical renter in the U.S. makes just $31,888.

RealEstateEconomyWatch.com Insight and Intelligence on Residential Real Estate

RealEstateEconomyWatch.com Insight and Intelligence on Residential Real Estate

One comment

Pingback: Soaring Rents Leave Homeownership Behind | Belair Realty